Discover what forms you need to use to report a foreign gift correctly

Whatever You Required to Learn About Reporting a Foreign Gift: A Comprehensive Overview

Reporting international presents is an essential element for united state organizations. Understanding the lawful needs and the effects of non-compliance is important for maintaining integrity. Organizations must browse intricate coverage limits and target dates. Correct paperwork plays an important function in this procedure. As the landscape of international donations develops, organizations have to adapt their methods as necessary. What are the ideal methods to assure conformity and openness?

Understanding Foreign Presents: Interpretation and Range

While lots of organizations might obtain various forms of support, comprehending international presents calls for a clear interpretation and extent. International presents refer to any solutions, funds, or materials given by international entities, individuals, or governments to U.S. organizations. These gifts can be available in various kinds, including cash money payments, property, research financing, and scholarships.

The scope of foreign gifts incorporates not just direct financial assistance however also in-kind payments that might influence the institution's operations or study top priorities. It is essential for organizations to acknowledge the implications of approving such presents, as they may carry certain problems or expectations from the donor. Understanding the nuances of foreign gifts aids companies in maintaining transparency and accountability while fostering international connections. Eventually, a complete understanding of foreign gifts is necessary for establishments to browse the complexities of financing and maintain their integrity in the academic and research study area.

Lawful Requirements for Coverage Foreign Present

Additionally, government regulations may require transparency concerning the resources of funding, particularly if linked to delicate research areas. Institutions have to maintain precise records of international gifts, ensuring they can confirm reported contributions throughout audits. This process frequently requires cooperation amongst different institutional divisions, consisting of finance, lawful, and compliance teams, to ensure adherence to both federal guidelines and institutional policies. Understanding these legal frameworks is vital for establishments to effectively manage and report international gifts.

Key Reporting Thresholds and Deadlines

Establishments should be mindful of certain reporting target dates and thresholds to confirm conformity with laws regarding international gifts. The U.S. Division of Education and learning calls for institutions to report any international presents exceeding $250,000 within a fiscal year. This limit encompasses both individual gifts and collective payments from a solitary international resource.

In addition, organizations have to report any kind of foreign presents exceeding $100,000 to the Foreign Representatives Registration Act (FARA) if the gifts are linked to lobbying or political activities.

Target dates for reporting are necessary; establishments are typically called for to submit yearly reports by July 31 for gifts received during the previous monetary year. Failing to satisfy these thresholds or target dates might bring about charges, consisting of loss of government funding. Therefore, establishments have to establish an attentive surveillance and reporting process to guarantee adherence to these crucial guidelines.

Just How to Correctly Paper and Report Foreign Present

Proper paperwork and coverage of international gifts need a clear understanding of the necessary conformity actions. This includes adhering to a required documentation checklist and adhering to established reporting procedures. Legal considerations need to also be taken into account to ensure complete conformity with appropriate laws.

Required Documents Checklist

Exact documents is important when reporting international gifts to identify conformity with governing requirements. Establishments should maintain a thorough record of each present, consisting of the donor's name, the quantity or worth of the gift, and the date it was gotten. In addition, a summary of the function of the present and any type of limitations enforced by the contributor ought to be documented. Communication with the donor, such as emails or letters, can provide context and verification. It is also crucial to consist of any relevant arrangements or contracts. Financial documents, such as financial institution declarations or invoices, need to sustain the worth of the gift. Correct organization and retention of these records will promote the coverage procedure and warranty adherence to guidelines.

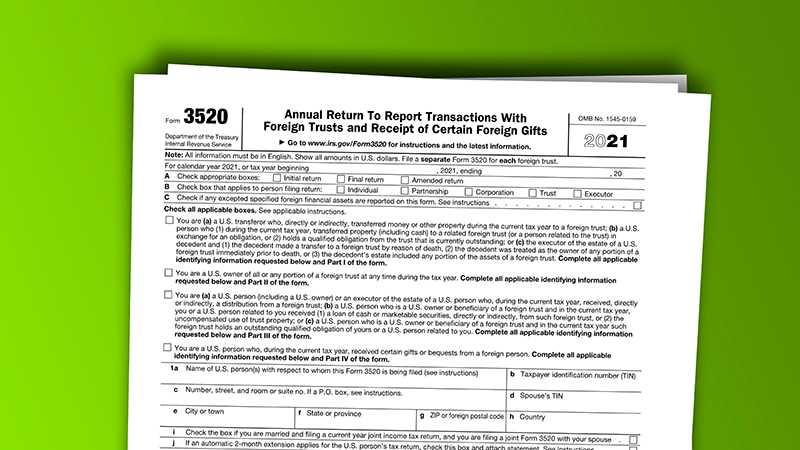

Coverage Procedures Review

When steering the complexities of reporting international presents, it is important to adhere to recognized treatments to guarantee compliance with governing requirements. Organizations must begin by identifying the nature and worth of the present, making certain accurate paperwork. This consists of putting together invoices, benefactor communication, and any relevant agreements. Next, entities need to send the needed kinds to the suitable governmental bodies, commonly consisting of the Division of Education or various other assigned agencies. It is critical to comply with due dates, as tardy submissions may cause fines. Furthermore, maintaining comprehensive documents of the reporting process is necessary for future audits. Companies need to educate their workers on these procedures to ensure consistent compliance throughout all divisions.

Conformity and Lawful Considerations

How can organizations check this site out assure they meet conformity and lawful standards when recording foreign presents? To establish adherence, institutions should establish a detailed coverage framework that consists of clear interpretations of international gifts and limits for reporting demands. Accurate documentation is important, requiring thorough documents of the present's resource, purpose, and value. Organizations ought to carry out inner plans for timely reporting to appropriate authorities, including federal companies, as stated by the Foreign Gifts and Contracts Disclosure Act. Educating personnel on conformity procedures and maintaining open lines of interaction with legal advise can informative post further boost adherence. Normal audits of foreign present documents methods will certainly help identify possible conformity voids, assuring organizations promote lawful standards while fostering openness in their economic partnerships.

Consequences of Non-Compliance in Reporting

Failure to abide by international gift reporting requirements can cause substantial legal charges for organizations. Furthermore, non-compliance may tarnish an establishment's credibility, threatening trust fund with stakeholders. Understanding these repercussions is necessary for keeping both moral and lawful requirements.

Lawful Charges for Non-Compliance

Non-compliance in reporting international presents can result in considerable lawful fines that may detrimentally affect people and institutions alike. The Federal federal government purely applies policies bordering international payments, and infractions can lead to extreme consequences, including substantial fines. Establishments may encounter fines getting to thousands of bucks for each circumstances of non-compliance, relying on the quantity of the unreported gift. Furthermore, individuals entailed in the reporting process may experience personal liabilities, including penalties or prospective criminal costs for willful disregard. The possibility for audits increases, leading to additional scrutiny of economic practices. In general, understanding and sticking to reporting demands is critical to prevent these severe lawful implications and assurance compliance with government regulations.

Effect on Institutional Track Record

While legal penalties are a considerable issue, the influence on an organization's reputation can be similarly extensive when it involves stopping working to report international gifts. Non-compliance can lead to public mistrust, damaging relationships with stakeholders, graduates, and potential donors. Establishments risk being viewed as undependable or doing not have openness, which can hinder future funding opportunities. Furthermore, unfavorable media coverage might intensify these concerns, leading to a durable taint on the institution's image. This erosion of reputation can have far-ranging consequences, consisting of lowered enrollment, difficulties in recruitment, and weakened collaborations with various other academic or research study institutions. Ultimately, the failure to stick wikipedia reference to reporting demands not just threatens monetary security yet also compromises the honesty and trustworthiness of the establishment itself.

Ideal Practices for Managing Foreign Gifts in Institutions

Effectively taking care of foreign presents in establishments calls for an organized method that prioritizes transparency and compliance. Organizations should establish clear plans outlining the acceptance, reporting, and usage of foreign presents. A committed committee can manage these policies, ensuring they straighten with both regulatory needs and institutional values.

Normal training for personnel associated with gift administration is important to preserve awareness of conformity commitments and moral considerations. Organizations need to carry out detailed due persistance on prospective international benefactors to assess any kind of prospective risks connected with approving their presents.

In addition, open interaction with stakeholders, consisting of professors and pupils, promotes trust fund and alleviates problems concerning international influences. Regular audits of international gift purchases can assist determine any discrepancies and copyright liability. By carrying out these ideal practices, organizations can properly browse the complexities of getting international gifts while securing their stability and credibility.

Regularly Asked Concerns

What Kinds Of Foreign Gifts Are Excluded From Coverage?

Can Foreign Present Be Used for Personal Expenditures?

International gifts can not be made use of for individual expenditures. They are meant for specific functions, typically related to instructional or institutional assistance, and mistreating them for personal gain could bring about lawful and ethical consequences.

Exist Fines for Late Coverage of Foreign Present?

Yes, penalties can be imposed for late reporting of foreign presents. These may include penalties or restrictions on future financing. Timely compliance is essential to prevent possible lawful and monetary repercussions related to such reporting requirements.

How Do Foreign Gifts Influence Tax Obligation Responsibilities?

Foreign gifts might influence tax commitments by potentially going through reporting needs and, in many cases, tax. Receivers need to divulge these gifts to ensure compliance with IRS policies and stay clear of fines or unforeseen tax obligation liabilities.

Can Establishments Refuse Foreign Gifts Without Reporting?

Institutions can refuse foreign gifts without reporting them, as there is no responsibility to accept donations. report a foreign gift. Nonetheless, if accepted, they have to stick to regulative requirements relating to disclosure and prospective implications on tax commitments

Foreign presents refer to any services, funds, or products provided by international entities, individuals, or federal governments to United state organizations. As institutions involve with foreign entities, they need to navigate a complicated landscape of legal requirements for reporting international presents. Establishments must preserve an in-depth record of each present, consisting of the donor's name, the amount or value of the gift, and the day it was received. Non-compliance in reporting international gifts can lead to significant legal penalties that might negatively impact institutions and people alike. While lawful penalties are a significant concern, the impact on an establishment's credibility can be equally profound when it comes to failing to report international gifts.